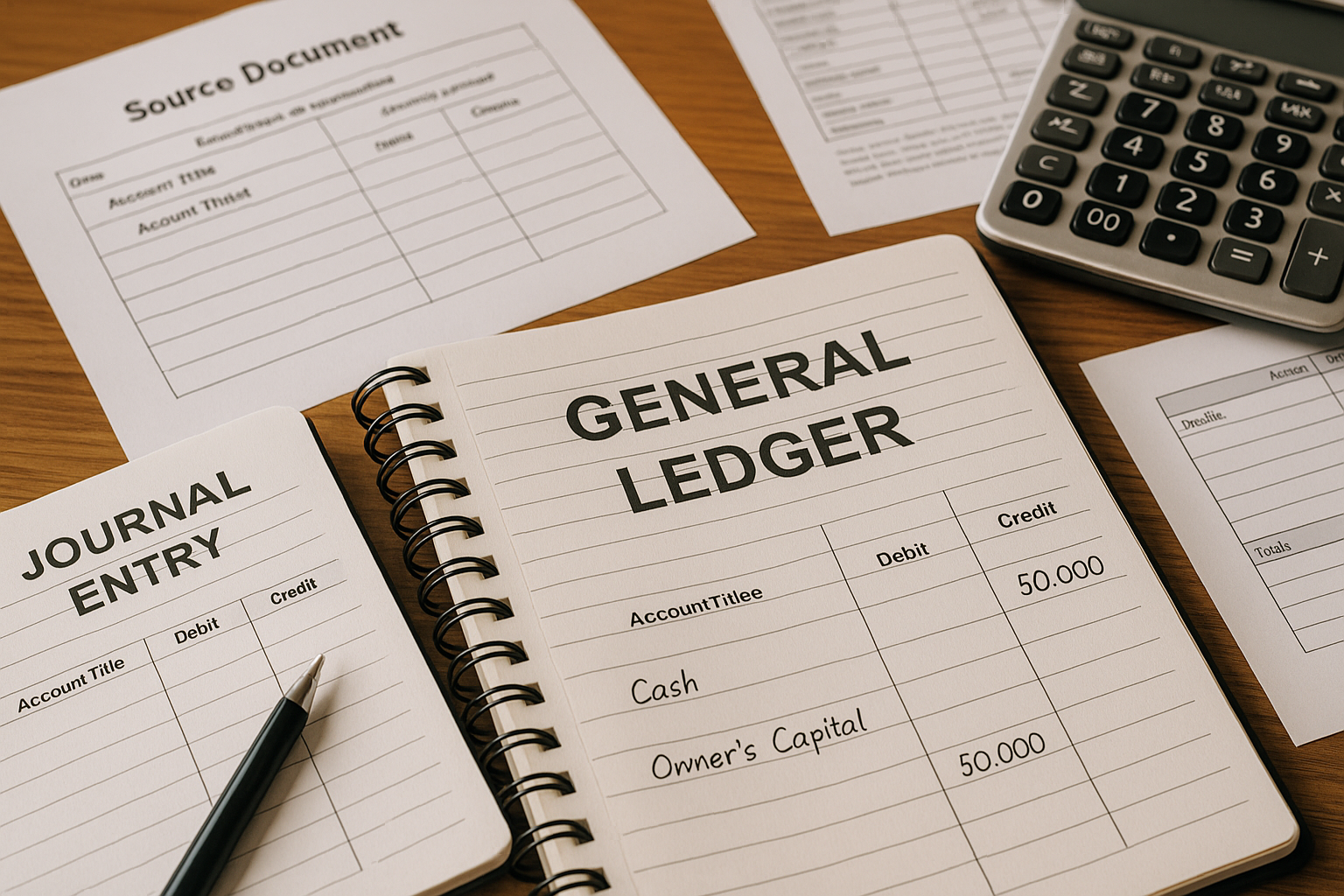

บทที่ 2 : วิเคราะห์และบันทึกรายการบัญชี พื้นฐานที่เจ้าของธุรกิจและนักบัญชีต้องเข้าใจ

วิเคราะห์และบันทึกรายการบัญชี พื้นฐานที่เจ้าของธุรกิจและนักบัญชีต้องเข้าใจ การวิเคราะห์และบันทึกรายการบัญชีเป็นขั้นตอนสำคัญของงานบัญชีที่ช่วยให้ข้อมูลทางการเงินของธุรกิจถูกต้อง ตรวจสอบได้ และนำไปใช้จัดทำงบการเงินอย่างมีมาตรฐาน ทั้งเจ้าของกิจการและนักบัญชีจึงควรเข้าใจหลักการนี้ให้ชัดเจน ก่อนต่อยอดไปสู่เรื่องการปิดงบ ภาษี และการวางแผนการเงินระยะยาว หากต้องการปูพื้นเรื่อง “บัญชีคืออะไร และเกี่ยวข้องกับธุรกิจอย่างไร” แนะนำให้อ่าน บทที่ 1…