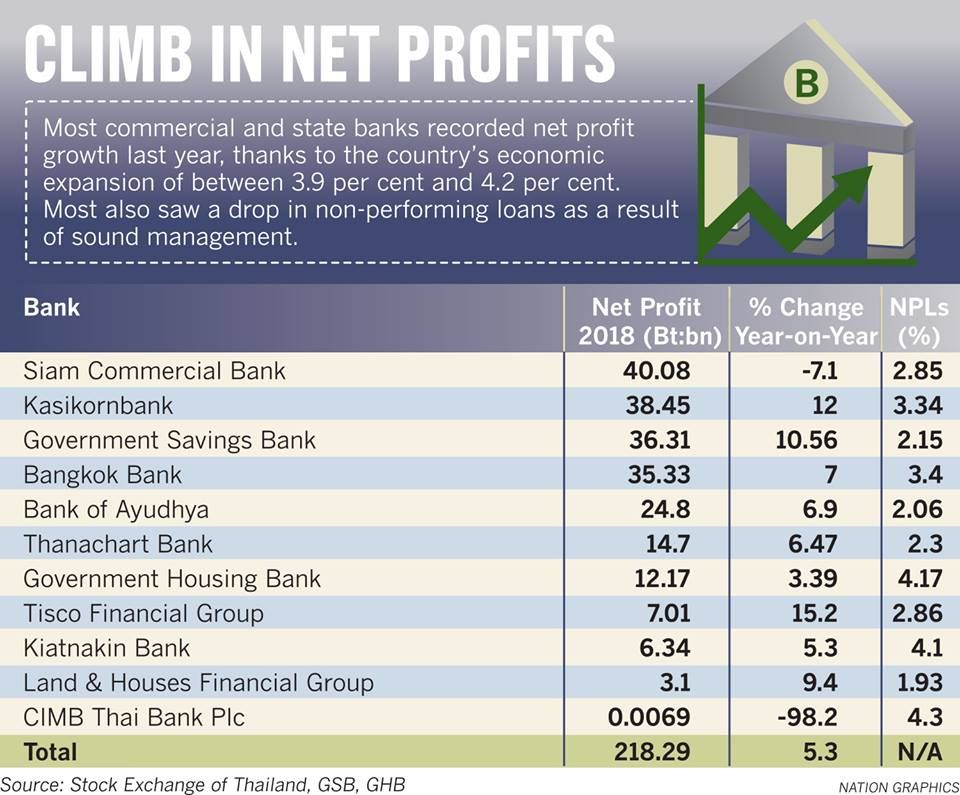

NINE commercial banks and two state banks have reported a combined net profit of Bt218.29 billion last year, representing a rise of 5.3 per cent from the previous year.

Of the nine commercial banks, seven posted growth in net profit while two others – Siam Commercial Bank and CIMB (Thai) Bank – saw declines.

Two state banks, Government Savings Bank and Government Housing Bank, recorded strong growth in net profit and a drop in non-performing loans (NPL) last year, compared with their 2017 results (see graphic).

Siam Commercial Bank’s president and chief executive officer, Arthid Nanthawithaya, said the bank and its subsidiaries had a combined net profit of Bt7.1 billion in the fourth quarter of 2018, and Bt40.1 billion for 2018 (based on unaudited consolidated financial statements), a 7.1-per cent year-on-year decrease from 2017.

Arthid attributed the decline to higher operating costs during a high investment cycle, necessitated by a transformation programme. It was temporary and the bank expects the cost-to-income ratio to improve over time, he said.

The bank’s core business remained strong, while its digital customer base has expanded significantly and become more engaged, he added.

This year, the bank will direct its efforts towards realising value from the transformation programme, in terms of delivering distinctive customer experiences and a differentiated value proposition, he said.

Patchara Samalapa, president of Kasikornbank, credited the bank’s net profit increase of Bt4.12 billion or 12 per cent last year to its setting of a lower allowance aligned with assets quality.

Moreover, net interest income increased by Bt4.377 billion or 4.65 per cent, coming mainly from loans and investments.

The Government Housing Bank president, Chatchai Sirilai, said the bank saw Bt213.16 billion worth of new loans last year totalling Bt1.11 trillion, which helped boost its net profit to Bt12.61 billion, up 3.39 per cent from 2017.

It also managed to reduce of its non-performing loans (NPL) level to 4.17 per cent of total loans, from 4.21 per cent in 2017. In 2019, the bank expects to approve new loans worth Bt203.26 billion and will further reduce its NPL level to 4.02 per cent, he said.

The Government Savings Bank (GSB) announced Bt64 billion in interest rate revenue and a net profit of Bt36.31 billion last year, up 10.56 per cent and 16.38 per cent respectively from 2017, the bank’s president and chief executive officer, Chatchai Payuhanaveechai, said at press conference recently.

The bank also reported a drop in NPLs to 2.15 per cent, lower than the average in the banking system.