Thai banks remain resilient in Q3 2020 but profits declined

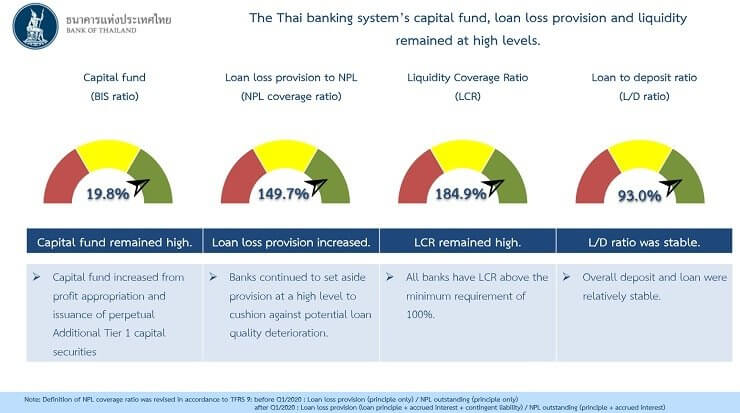

Ms. Suwannee Jatsadasak, Senior Director, Bank of Thailand, reported on the Thai banking system’s performance in the third quarter of 2020 that the Thai banking system remained resilient with high levels of capital fund, loan loss provision and liquidity to support economic recovery from the COVID-19 pandemic.

Debt relief measures, coupled with revisions to rules on loan classification and provisioning facilitated bank loan expansion and alleviated the deterioration of bank loan quality. Meanwhile, banking system’s profitability declined as banks continued to set aside loan loss provision at a high level as a cushion against a potential adverse impact of COVID-19 on loan quality.

Details are as follows:

Capital Fund of the Thai banking system was at 2,959 billion baht, equivalent to capital adequacy ratio (BIS ratio) of 19.8%.

Loan loss provision remained high with NPL coverage ratio of 149.7%

Loan loss provision remained high at 782.5 billion baht with NPL coverage ratio of 149.7%. Liquidity coverage ratio (LCR) registered at 184.9%.

In the third quarter of 2020, banks’ overall loan growth stood at 4.6% year-on-year, a slight decline from last quarter at 5.0%. Details on bank loan are as follows:

Corporate loan (64.6% of total loan) expanded at 4.5% year-on-year, but contracted quarter-on-quarter as some large corporates switched their funding source from bank loan to bond and equity issuance. SME loan1 contracted at a lower rate, attributed to the soft loan scheme and a gradual economic recovery.

Consumer loan grew at 4.8% year-on-year

Consumer loan (35.4% of total loan) grew at 4.8% year-on-year, and increased quarter-on-quarter following the relaxation of lockdown measures. In particular, mortgage lending expanded, consistent with an increase in demand for low-rise residential properties from last quarter.

Ms. Suwannee Jatsadasak, Senior Director, Bank of Thailand, reported on the Thai banking system’s performance in the third quarter of 2020 that the Thai banking system remained resilient with high levels of capital fund, loan loss provision and liquidity to support economic recovery from the COVID-19 pandemic.

Debt relief measures, coupled with revisions to rules on loan classification and provisioning facilitated bank loan expansion and alleviated the deterioration of bank loan quality. Meanwhile, banking system’s profitability declined as banks continued to set aside loan loss provision at a high level as a cushion against a potential adverse impact of COVID-19 on loan quality.

Details are as follows:

Capital Fund of the Thai banking system was at 2,959 billion baht, equivalent to capital adequacy ratio (BIS ratio) of 19.8%.

Loan loss provision remained high with NPL coverage ratio of 149.7%

Loan loss provision remained high at 782.5 billion baht with NPL coverage ratio of 149.7%. Liquidity coverage ratio (LCR) registered at 184.9%.

In the third quarter of 2020, banks’ overall loan growth stood at 4.6% year-on-year, a slight decline from last quarter at 5.0%. Details on bank loan are as follows:

Corporate loan (64.6% of total loan) expanded at 4.5% year-on-year, but contracted quarter-on-quarter as some large corporates switched their funding source from bank loan to bond and equity issuance. SME loan1 contracted at a lower rate, attributed to the soft loan scheme and a gradual economic recovery.

Consumer loan grew at 4.8% year-on-year

Consumer loan (35.4% of total loan) grew at 4.8% year-on-year, and increased quarter-on-quarter following the relaxation of lockdown measures. In particular, mortgage lending expanded, consistent with an increase in demand for low-rise residential properties from last quarter.

Debt relief measures, together with revisions to rules on loan classification and provisioning, have continued to alleviate banks’ loan quality deterioration in the third quarter of 2020. The gross non-performing loan (NPL or stage 3) outstanding was at 513.9 billion baht, equivalent to 3.14% of total loan, slightly edging up from 3.09% in the previous quarter.

Meanwhile, the ratio of loans with significant increase in credit risk (SICR or stage 2) to total loans was at 7.03%, down from 7.49% in the last quarter.

The banking system recorded net profit of 28.0 billion baht in the third quarter and 130.4 billion baht for the first 9 months of 2020, a decline from last year due to continued high level of provisioning expenses to cushion against potential loan quality deterioration going forward.

As a result, the ratio of return on asset (ROA) declined to 0.52% from 0.60% in the last quarter. The ratio of net interest income to average interest-earning assets (Net Interest Margin: NIM) declined from 2.60% to 2.55%, largely due to a decline in interest income on loan.

(1) Corporates with a maximum credit line of 500 million baht with a bank.