Thailand’s dangerous debt addiction

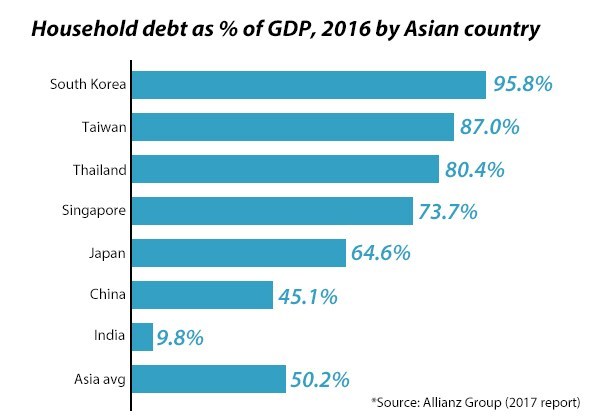

Thailand is now a top-ten highest household debt country among 89 countries worldwide and third highest among 29 Asian countries.

Thailand’s household debt has steadily increased to 78.6% of the country’s gross domestic products (GDP), or Bt12.8 trillion in the fourth quarter of last year, according to figures from the National Economic and Social Development Council.

A study by the Bank of Thailand reports that Thais get into debt in their 20s and tend to borrow more as they age and the level of their debt is maintained even as they approach retirement.

Speaking at the Bangkok Sustainable Banking Forum 2019 today, Veerathai Santiprabhob, Governor of the Bank of Thailand highlighted several aspects of the potential role of the financial sector in addressing common challenges facing the Thai society, such as income inequality, environmental degradation, excessive household debt, and the persistent problem of corruption.

Thais have more personal debt, as the median average debt obligation for each person doubles from Bt70,000 in 2010 to Bt150,000 in 2016, the Bank of Thailand reported, moreover, almost 16%, or 3 million Thais, have debt payments which are 90-days overdue.

Over the past few years, heightened competition in the real estate sector along with rising property prices, had led to aggressive sales and promotional campaigns by property developers, attracting real as well as speculative buyers. Seeing opportunities in the sector, some banks significantly relaxed their lending standards for mortgage loans, noted Mr Santiprabhob.

ata revealed that as high as 25 percent of new mortgage and related loans originated in 2018 had loan-to-value ratio above 100 percent. Moreover, numbers of homebuyers were getting mortgage credit lines in amounts much higher than the underlying property purchasing values, essentially gaining the extra “cash-back” from their borrowing activities.

VEERATHAI SANTIPRABHOB, GOVERNOR OF THE BANK OF THAILAND

This created perverse incentives for individuals to buy homes merely to earn the cash-back, for use on general spending. These increasingly laxed mortgage lending standards by banks have in part worsened the household debt situation in Thailand.

The Bank of Thailand has recently introduced macro-prudential measures to mandate that financial institutions assess each borrower’s ability to repay a loan based on a prudent debt-service ratio.

When financial institutions focus mainly on short-term gains, neglecting the potential long-term effects or negative spillover of their activities, this can in fact increase financial institutions’ risks; risks that can impair their credibility, public trust, and financial positions in the long-run.

VEERATHAI SANTIPRABHOB, GOVERNOR OF THE BANK OF THAILAND

But without better credit culture and internal controls, it will be difficult for the Thai financial institutions to limit the worsening of household debt : trapped in a debt cycle, indebted household often don’t have sufficient financial literacy or spending discipline.