The Bank of Thailand Bond Issuance Program for 2020 (1st Revision)

The Bank of Thailand (BOT) regularly issues BOT bonds, one of the monetary policy instruments, to manage liquidity in the money market and foster liquid and efficient debt securities market in Thailand. The annual BOT bond issuance program is communicated to the market at the start of each year to allow market participants to plan their liquidity management accordingly.

In recent months, the global Covid-19 outbreak has led to widespread impacts on the economy and financial markets in Thailand. Volatility in the bond market has surged and is expected to remain elevated in the period ahead. Also, the increase in the government’s financing needs to fund economic relief measures could affect overall supply of sovereign bonds in the market.

Against such backdrop, the BOT has been working closely with the Public Debt Management Office (PDMO) to ensure appropriate level of public sector bond supply, given the government’s funding plans as well as changing investors’ demand amidst the highly uncertain global environment. In view of this, the BOT has made the following adjustments to the 2020 BOT Bond Issuance Program, effective from May 2020 onward.

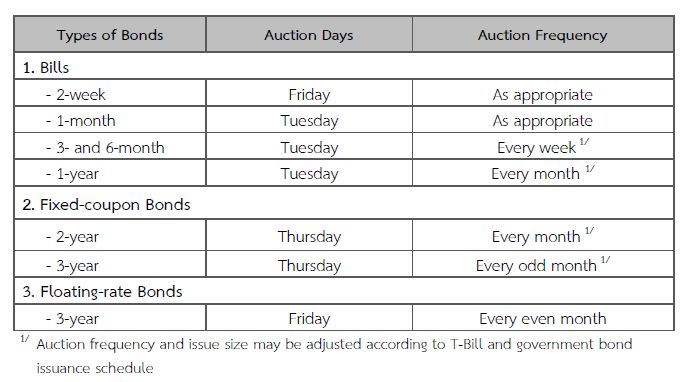

1. Auction schedules

Overall, the auction days and frequency will remain as announced at the beginning of 2020. However, if necessary, the BOT may consider adjusting the auction frequency of the 3- and 6-month BOT bills, and the fixed-coupon bonds, to accommodate the issuance schedule of Treasury Bills (T-bills) and government bonds of comparable maturities. The revised auction schedule can be summarized as follows.

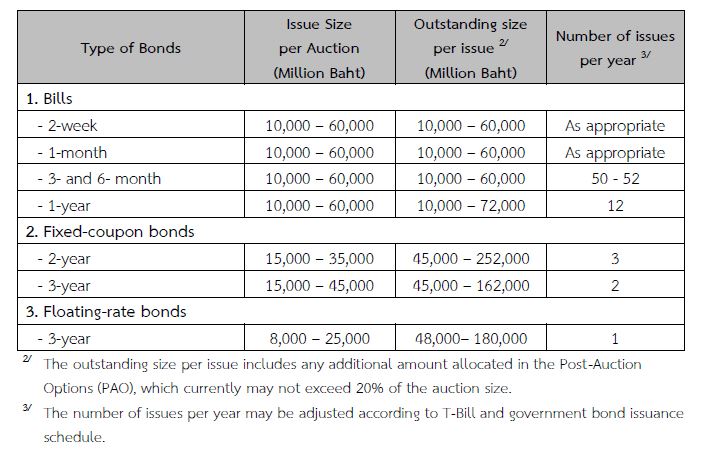

2. Issue size

The ranges of maximum and minimum issue size per auction are expanded to 10,000 – 60,000 million baht for all maturities of BOT bills. This will allow greater flexibility in adjusting BOT bill issuance sizes to accommodate government funding plans and changes in investors’ demand. Details of the revised issue sizes and total outstanding sizes are as follows.

3. The announcement schedule of monthly bond issuance programs

Monthly BOT bond auction schedules will continue to be announced prior to the beginning of each month on the BOT website, as has been done in previous years. When necessary, however, the BOT reserves the right to make adjustments to the issue sizes during the month in cases where the demand for BOT bills and bonds change significantly from prior projection. Should such adjustments be needed, the BOT will notify market participants of the changes at least 2 days before the auction dates.

Looking ahead, the BOT will continue to collaborate closely with the PDMO in setting the issue sizes and auction schedules for BOT bills and bonds. The BOT will take into account government and SOE bill and bond supply, along with conditions in the domestic and global bond markets, in determining issuance plan to ensure a smooth and efficient functioning of Thailand’s bond market in periods to come.