Why pay 7% VAT and what do you get in return

BAGKOK (NNT) – Valued Added Tax, or VAT, is a familiar concept among the Thai people but is brought up for debate on an almost annual basis, often becoming a political issue. What are the origins of VAT What is the VAT rate in developed nations What is point of VAT The Public Relations Department now presents a simple understanding of VAT.

#GettingToKnowVAT 7%VAT

Value Added Tax is a tax that is collected whenever consumption takes place; it is collected by the government from vendors, indirectly taxing citizens as the VAT rate is usually added to the price of a product or service. The tax is paid to the Revenue Department to be added to the national budget and is used on various expenditures. VAT is clearly indicated in any tax invoice where it has been charged.

VAT is calculated by the equation Price of Product/Service x 7%. For example, if NNT company sells a lamp worth 1,070 Baht, 1,000 Baht is the capital cost and 70 Baht is the VAT. NNT company must deliver the collected tax to the Revenue Department on a monthly basis.

Thailand’s VAT rate was actually 10 percent when it was introduced in 1992, but a Royal Decree in 1997 reduced it to 7 percent with reconsideration taking place every two years. This was done for the sake of the public during the economic crisis at the time, commonly known as the “Tom Yum Kung” financial crisis. Twenty years later the 7 percent rate still stands, instead of the original 10 percent.

A major issue in Thailand is tax collection not meeting targets, which impedes expenditure on national development. This is exacerbated by the general public’s apathy and a resistance towards paying tax, which is actually a civic duty. While citizens may want good welfare and national infrastructure matching that of developed countries, avoidance of taxes has made this reality difficult to actualize.

How does VAT help the public

Tax payments not only support the administration of the country but come with a number of other benefits in the form of welfare, which enhances the quality of life from birth to death. Simply put, taxes paid by citizens ultimately better their lives through expenditure directed by the government. VAT contributes to the following expenditures (in accordance with the Annual Budget Act)

1. Education

2. Senior Citizen Benefits

3. National Security

4. Transport

5. Public Health (including the Gold Card)

6. Hospitals

7. Police

8. Others

Amid the COVID-19 crisis, which has impacted public life and the economy in Thailand and across the globe, maintaining fiscal stability has become crucial. Over the past year, government revenue dropped 6.8 percent on-year, with the government only collecting 2.39 trillion baht in fiscal 2020 (as of 31st December, 2020) as a direct result of lower tax payments.

Despite the drop in revenue, it is not possible for the government to reduce the efficiency of its services, especially in these trying times. Meanwhile, Deputy Prime Minister and Minister of Energy Supattanapong Punmeechaow, has given his word that the VAT rate will not be raised in this two year period.

Minister of Finance Arkom Termpitayapaisit, said today that the VAT rate being used until September this year will be maintained for another year, making known the promise will be put to Cabinet. He gave his word the rate would not be adjusted until the entire tax system is overhauled, with relevant agencies currently studying the matter. He admitted however, that after the year period has finished, the situation will have to be reassessed.

What is the VAT rate of developed nations

Advanced economies maintain different VAT rates, but it is their comprehensive collection that leads to improved public life and services. Developed nations have the following VAT rates:

Japan VAT 8%

South Korea VAT 10%

China VAT 17%

Australia VAT 10%

New Zealand VAT 12.5%

Norway VAT 25%

United Kingdom VAT 20%

Germany VAT 19%

Austria VAT 20%

Denmark VAT 25%

Finland VAT 23%

France VAT 19%

Italy VAT 20%

Canada VAT 7 – 25%

Global Average 15.5%

The United States of America does not collect VAT, but instead has Sales Tax, which changes rate from state to state and is imposed directly on buyers and excludes added State Tax.

Overall, developed nations impose high VAT rates, which is done so that their governments can effectively provide public services. On top of the high VAT rates, these countries also have high rates of income and revenue tax across all their citizens, usually 40 percent or higher for more than 80 percent of their population.

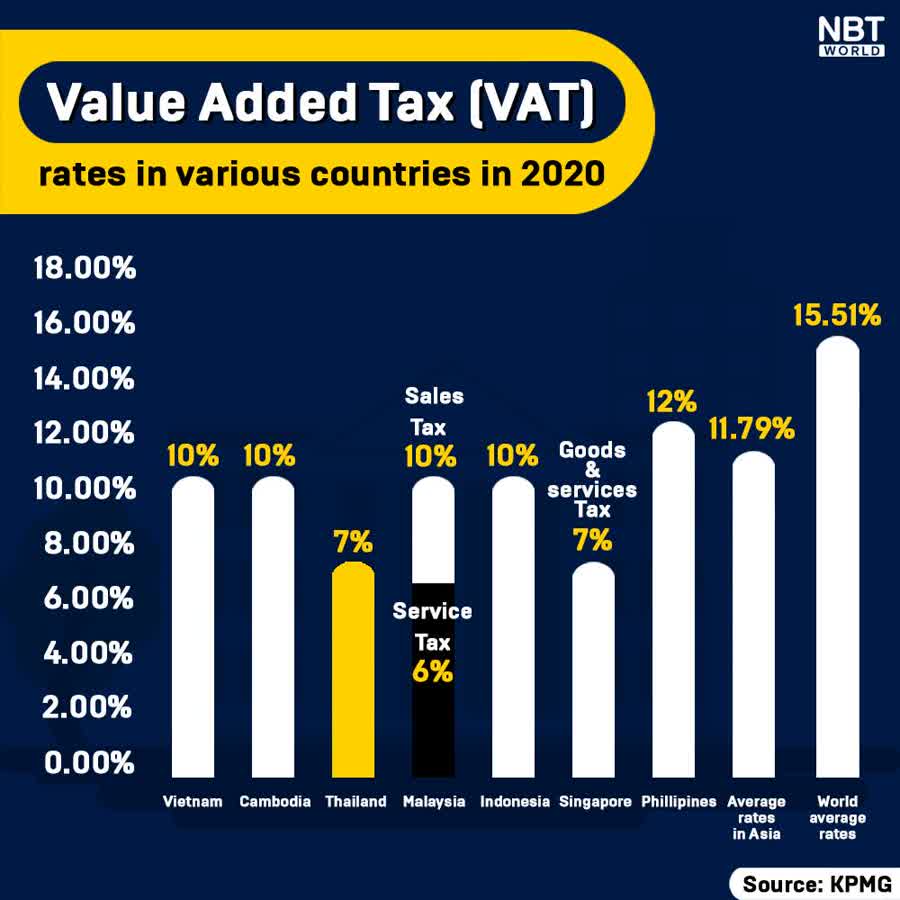

VAT rates in ASEAN:

In ASEAN, Thailand has the lowest VAT rate alongside Singapore.

Revenue Department data shows that in 2019, of the 68.86 million citizens of Thailand, only 11 million filed a tax return, or 16.18 percent, with only 5 million people paying taxes as required out of 30 million working adults. Revenue that year was only 0.3 trillion Baht with income tax the third most paid tax after VAT and corporate tax.

Often, when politicians run on platforms promising lower VAT rates, they are simply posturing for votes, as such a reduction would have a considerable impact in light of the country’s low annual revenue. A simple cut to VAT could impact both public welfare and government operations. Hearing such a claim should give citizens pause, as they could be supporting a process that would ultimately be to their detriment.